Type-1 Remittance License

Japan’s Type-1 Funds Transfer Service license allows approved non-bank operators to send and receive unlimited remittance amounts. For inbound flows, this means international funds sent by overseas partners can be delivered locally in yen to Japanese recipients through a regulated, trusted channel.

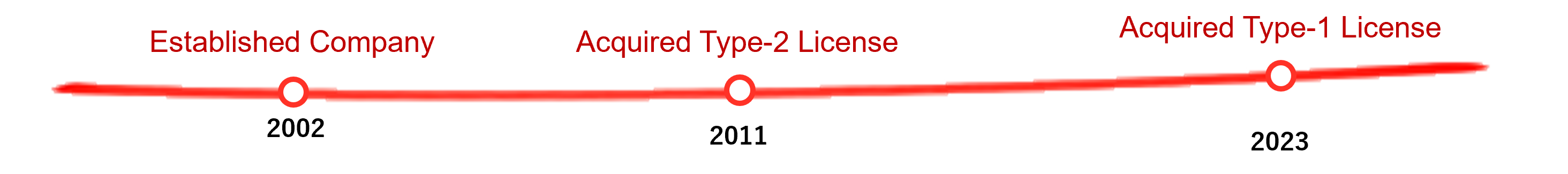

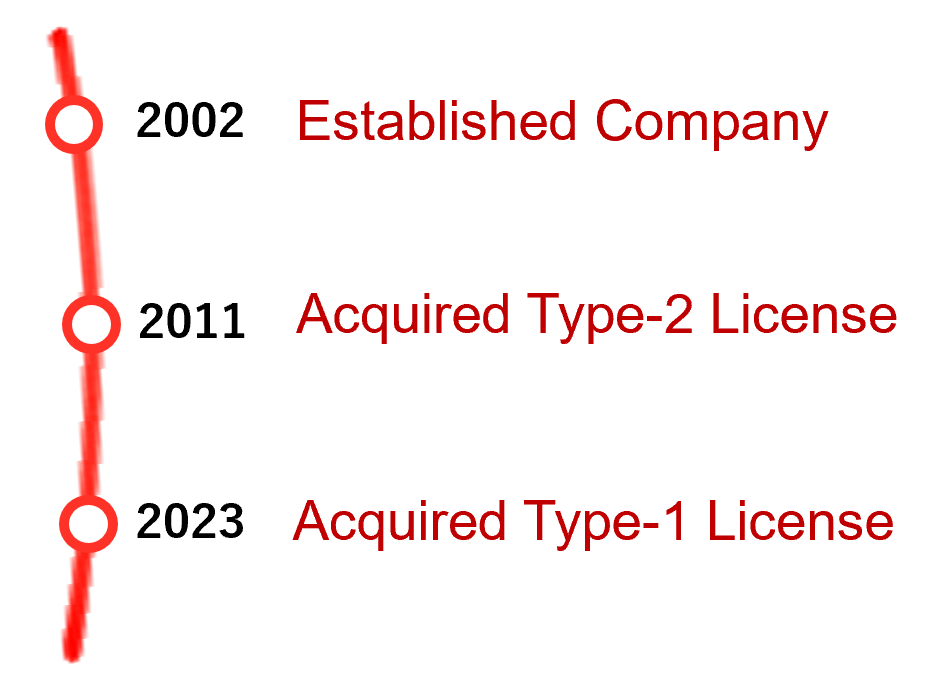

C-Square was the first company to apply for a Type-1 License and also the first company to introduce Type-1 licensed products to the Japan market, being awarded its Type-1 Licence in June 2023 by Japan’s Financial Services Agency, allowing the handling of transaction volumes exceeding 1 million JPY, beyond the limitations of Japan’s Type-2 license.